Top 10 Trending Stock Ratings: Tom Lee Calls Latest Selloff a Buying Opportunity

Tom Lee says the selloff is a buying opportunity. Read the Top 10 trending stock ratings and analyst calls to find buy-the-dip opportunities and manage risk.

Page views: 3

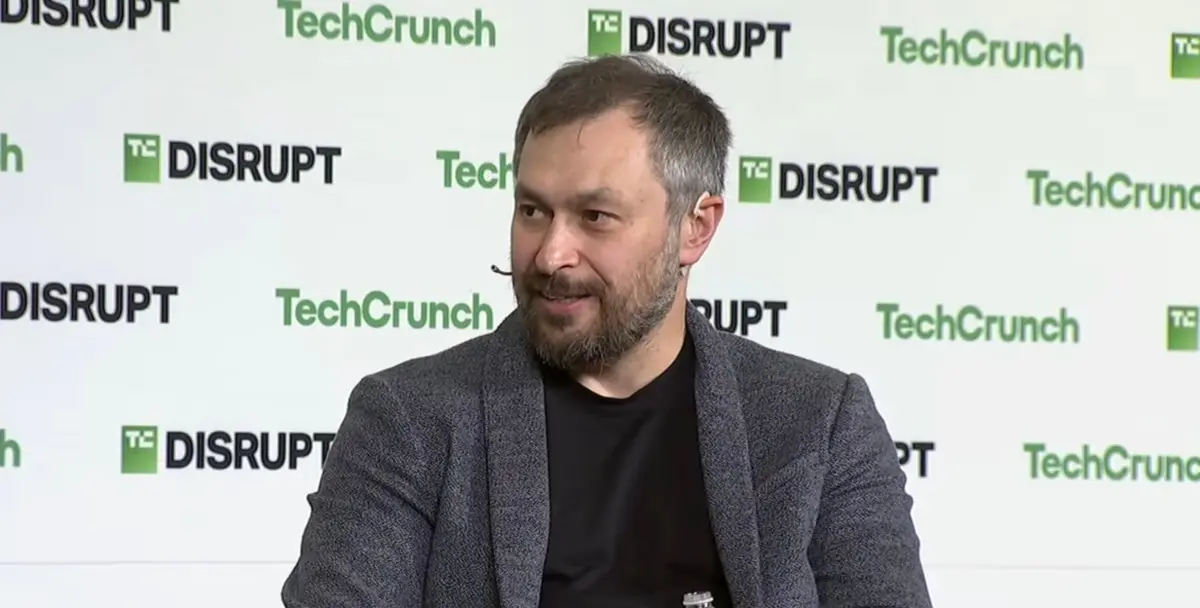

Markets plunged after President Donald Trump announced new China tariffs, triggering a Friday bloodbath that rattled investors. Amid the volatility, Tom Lee of Fundstrat told CNBC the selloff could represent a buying opportunity for disciplined investors. That view has refocused attention on trending stock ratings and analyst calls.

Below are the Top 10 trending stock themes and calls to watch as market volatility unfolds. These are themes and rating trends—not individual investment advice—but they reflect where analysts and strategists are shifting focus after the tariff news.

1) Large-cap tech — Many analysts maintain buy-the-dip calls on blue-chip tech, citing durable earnings power and long-term growth in cloud and AI services.

2) Semiconductors — With chipmakers seeing cyclical pressure, several ratings have trended toward buy as demand forecasts stabilize and inventories normalize.

3) Cloud and software — Subscription-based software names remain in favor for steady revenue streams, earning repeated overweight ratings from analysts.

4) Consumer discretionary (selective) — Retail winners with strong balance sheets and omnichannel strength are getting positive revisions as consumers reallocate spending.

5) Healthcare and selective biotech — Defensive healthcare stocks and high-conviction biotech names are drawing upgrades as investors seek quality amid uncertainty.

6) Industrials and supply-chain plays — Stocks tied to infrastructure and logistics are being re-rated, with some analysts seeing upside if trade tensions ease.

7) Energy and commodities — Rising commodity prices and long-term demand outlooks have prompted renewed interest and bullish calls in select energy names.

8) Financials — Banks and insurers with solid capital positions are receiving mixed-to-positive ratings as rate outlooks shift and lending activity remains resilient.

9) Dividend-paying defensives — Utilities and consumer staples with reliable dividends are trending as safe-haven choices during market selloffs.

10) Small-cap recovery plays — Analysts are flagging beaten-down small-caps as potential high-reward opportunities for investors willing to tolerate volatility.

Tom Lee’s view that a selloff can be a buying opportunity highlights an investing strategy centered on discipline: focus on quality, dollar-cost averaging, and risk management. Use analyst ratings to inform research but always confirm with your own due diligence. In volatile times driven by headlines like China tariffs, diversify, set stop-losses if appropriate, and consult a financial advisor to align any buy-the-dip moves with your long-term goals.

Published on: October 13, 2025, 7:02 am