Why Investing in the Crypto Economy Makes Sense in 2026

In 2026, investing in the crypto economy—infrastructure, exchanges and Web3—can provide diversified exposure to digital assets amid regulatory change.

Page views: 2

The crypto market has matured since its early, coin-centric days. In 2026, investing in the broader crypto economy rather than betting on individual cryptocurrencies can offer a more resilient path to long-term exposure to digital assets. Focusing on infrastructure, platforms and service providers captures value from adoption and innovation across the whole ecosystem.

Diversification is the core advantage. Crypto infrastructure firms, exchanges, custody providers, blockchain index funds and Web3 application platforms tend to move differently than single tokens. When one coin underperforms, demand for core services like secure custody, decentralized finance rails and payment integrations can remain strong. That creates a smoother risk-return profile compared with concentrated coin bets.

The regulatory landscape is clearer than it was, and institutional adoption continues to grow. In 2026, clearer rules often mean more institutional products such as crypto ETFs, regulated custody solutions and tokenized securities. These developments make it easier to access the crypto economy via familiar channels, improving liquidity and lowering operational risk for investors.

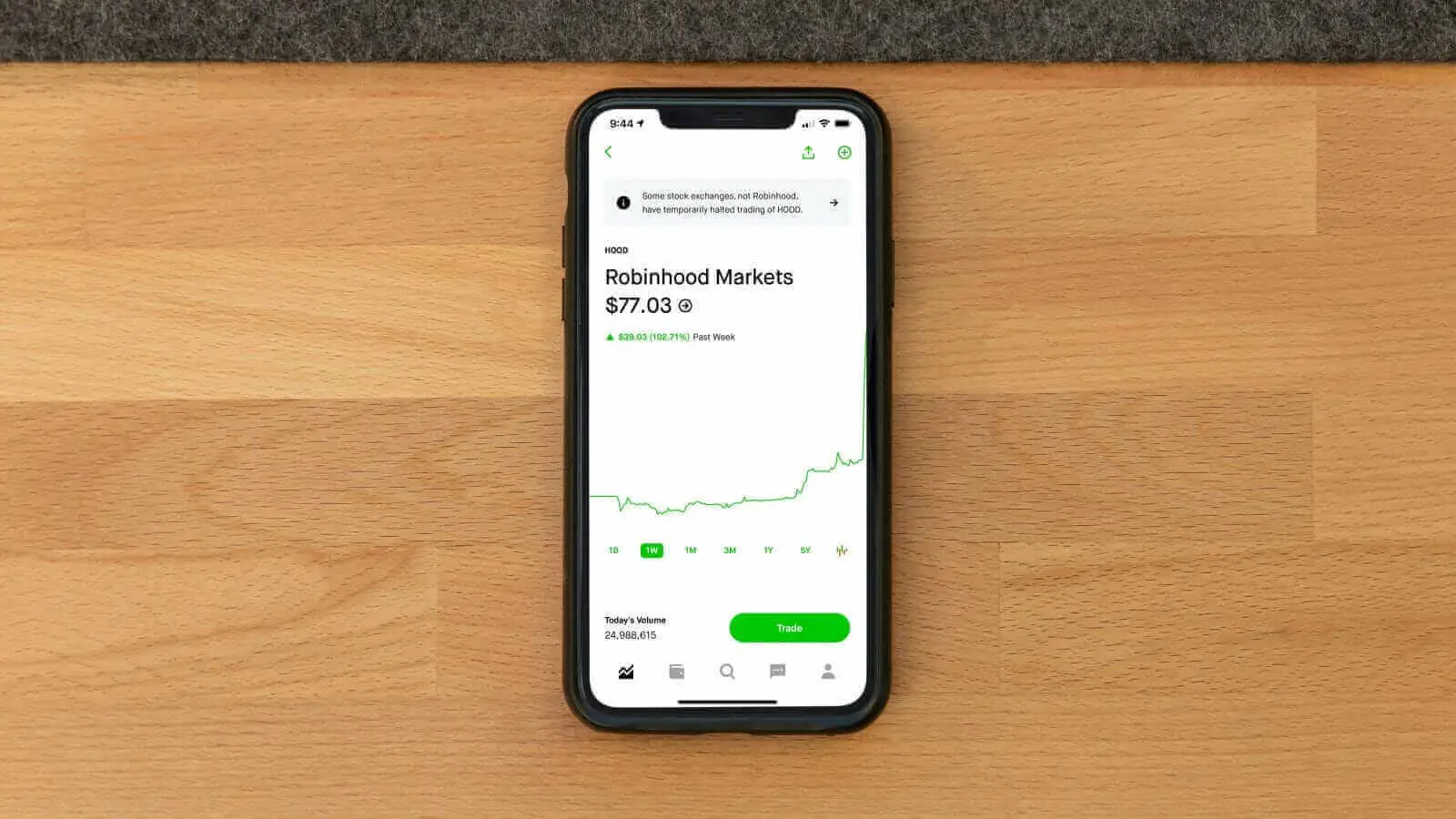

How to gain exposure to the crypto economy. Consider diversified approaches: crypto-focused ETFs, publicly traded companies with blockchain revenue, index funds that track a basket of digital-asset service providers, or venture and private equity funds focused on Web3 infrastructure. For long-term investors, a mix of liquid ETFs and selectively chosen equities or tokens tied to infrastructure and services can balance growth and accessibility.

Risk management remains essential. Even infrastructure plays face technology, regulatory and execution risk. Keep allocations moderate, rebalance periodically, and use dollar-cost averaging to reduce timing risk. Evaluate custody and counterparty risk carefully when using exchanges or staking services. Always check an investment product's fee structure and governance before committing capital.

Conclusion: In 2026, the crypto economy offers a pragmatic alternative to concentrated crypto picks. By prioritizing infrastructure, platforms and regulated vehicles, investors can tap structural growth in blockchain adoption while managing volatility. This is not financial advice; consult a qualified advisor to align any crypto economy allocation with your goals and risk tolerance.

Published on: February 3, 2026, 9:02 am