Truth Predict: Trump Family’s Move into Crypto Betting Raises Conflict-of-Interest Concerns

Truth Social's 'Truth Predict' teams with Crypto.com, sparking conflict-of-interest and corruption concerns after Reuters reports massive crypto gains by the Trump family.

Page views: 2

The Trump family’s business interests have expanded again — this time into online betting. Financial Times reports that Truth Social is launching “Truth Predict,” a prediction market in partnership with Crypto.com that will let users place wagers on elections, sports and other events. The move ties the president’s social platform directly to cryptocurrency and online betting, prompting fresh ethics questions.

Truth Predict is part of a broader trend of the Trump family becoming more involved in crypto and betting markets. Donald Trump Jr. has reportedly taken advisory roles at leading prediction market companies and invested through his venture capital firm. Those ties, combined with the Truth Social partnership, have critics warning of an obvious conflict of interest when political outcomes could be wagered on through platforms connected to the president.

The timing stoked further controversy after Reuters published calculations showing a dramatic increase in income tied to the family’s crypto venture. According to that reporting, the Trump Organization’s realized income jumped substantially, largely driven by a Trump-backed cryptocurrency. Observers say the scale of those gains — and the role of major crypto players like Crypto.com and Binance — merit scrutiny.

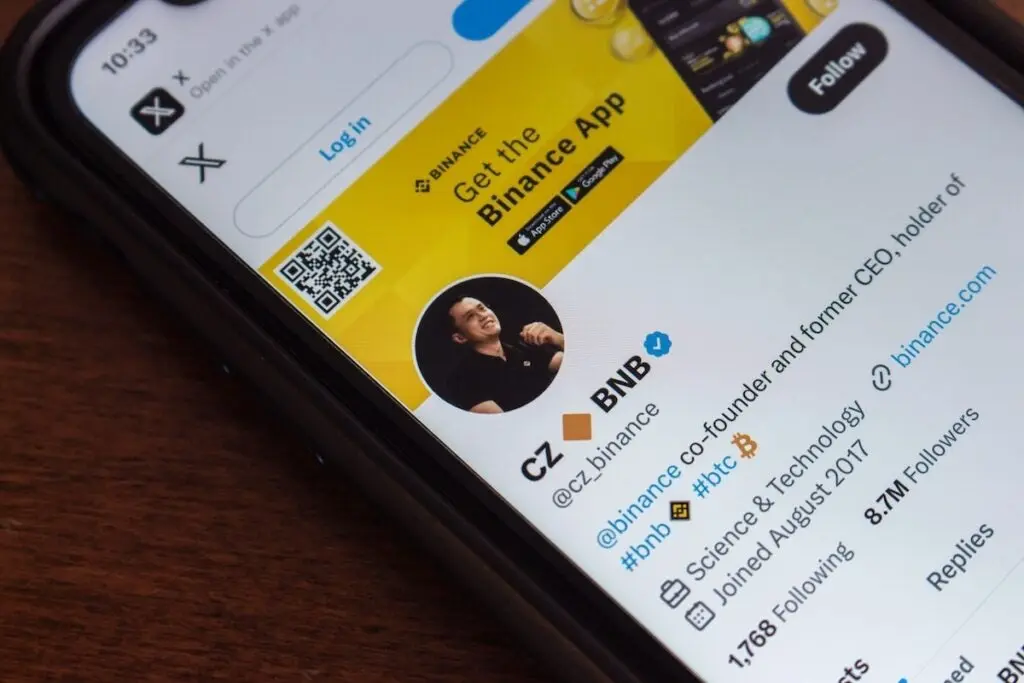

Critics point to a chain of events that includes a presidential pardon for Binance founder Changpeng Zhao and aggressive promotion of meme coins associated with the Trump family. Law and ethics experts cited by reporters argue that investors may be seeking favorable treatment or reduced regulatory pressure by backing ventures linked to the president, raising questions about influence, transparency and national security.

Supporters, including some congressional figures, argue disclosure and openness distinguish these business activities from secrecy. But opponents counter that disclosure alone doesn’t resolve the risk that a sitting president could benefit financially from markets tied to political outcomes. Calls for oversight are growing from lawmakers and watchdogs who want to probe whether these ventures comply with existing regulations for derivatives, gambling and campaign ethics.

As Truth Predict moves from announcement to launch, regulators, journalists and policy makers will likely watch closely. The convergence of social platforms, cryptocurrency and prediction markets creates new legal gray areas — and a high-stakes test of how existing ethics and financial rules apply when politics and private profit intersect.

Published on: October 30, 2025, 9:02 am