Todd Blanche, DOJ and Crypto: Ethics and Conflict Concerns

Todd Blanche faced ethics scrutiny after ordering DOJ crypto enforcement rollbacks while holding Bitcoin and crypto assets, raising ethics, conflict concerns.

Page views: 2

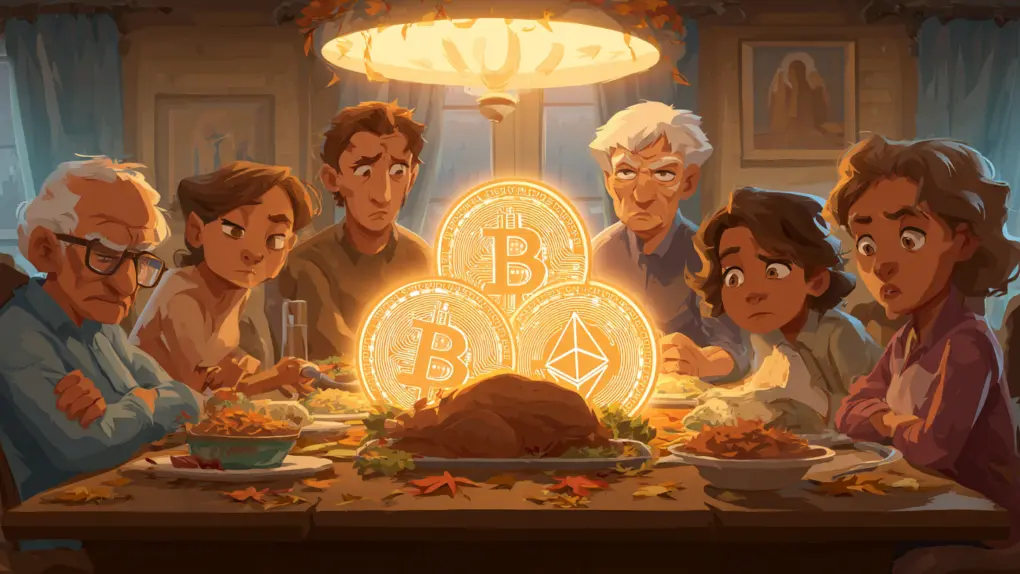

Todd Blanche, the Justice Department’s second-highest official and a former personal attorney for Donald Trump, has drawn scrutiny for actions critics say created crypto conflicts of interest. Ethics experts told ProPublica that Blanche’s April memo rolling back Biden-era crypto enforcement violated federal conflict rules and his own ethics agreement because he still held significant cryptocurrency investments.

Blanche promised to divest virtual assets within 90 days of his March confirmation, but about a month into the job — before fully divesting — he ordered an end to investigations into crypto companies, dealers and exchanges. He also disbanded the National Cryptocurrency Enforcement Team, which had won high-profile convictions and helped probe major exchanges. The memo emphasized the Trump administration’s push to make the United States a global leader in digital assets.

Legal and ethics experts say Blanche’s directives mattered financially. At the time of the memo, Blanche still owned Bitcoin, Ethereum and other tokens valued in the tens or hundreds of thousands of dollars. Although he later transferred many holdings to adult children and a grandchild — a move that is technically legal — experts argue the transfer undermines the spirit of divestiture and can still leave room for family financial benefit.

Blanche’s case is part of a broader pattern in the Trump administration: dozens of senior appointees owning cryptocurrency investments and taking pro-crypto regulatory steps. High-ranking officials who previously pledged divestiture have often transferred assets to relatives or filed ethics paperwork that leaves unanswered questions about timing and compliance. Critics say this trend weakens traditional safeguards meant to prevent officials from shaping policy that benefits their own investments.

The rollback of enforcement and the rhetoric favoring crypto markets immediately boosted trading and reassured industry supporters. But former ethics officials warn about the long-term costs: eroded public trust, potential for regulatory capture, and weakened enforcement against money laundering and fraud in digital assets.

As government oversight of cryptocurrency evolves, the Blanche episode highlights the need for clearer ethics rules and more transparent divestiture practices. Whether through stronger recusals, explicit limits on transfers to family, or tightened disclosure requirements, policymakers must address conflicts of interest to ensure that crypto policy serves the public interest — not private portfolios.

Published on: December 26, 2025, 8:02 am