Exploring the Impact of Cryptocurrency Holdings on Mortgage Applications

Federal housing regulators consider crypto assets in mortgage applications, reflecting growing acceptance of digital currencies in finance.

Page views: 2

With the growing integration of cryptocurrency into mainstream finance, federal housing regulators are now considering the impact of crypto holdings on mortgage applications. In a recent announcement on social platform X, Bill Putle, Director of the Federal Housing Finance Agency, stated that his department will review how crypto assets might be included in income checks by entities like Fannie Mae and Freddie Mac. This move could significantly alter how mortgage applications are evaluated, particularly in determining an applicant's net worth and liquidity.

Putle's statement, highlighted by CoinDesk, comes amidst a period of increasing acceptance of the cryptocurrency sector in the United States, particularly under President Donald Trump's administration. As an investor with substantial stakes in cryptocurrency, including up to $1 million in crypto assets and investments in firms like MARA Holdings and Elon Musk's X, Putle's insights are especially relevant.

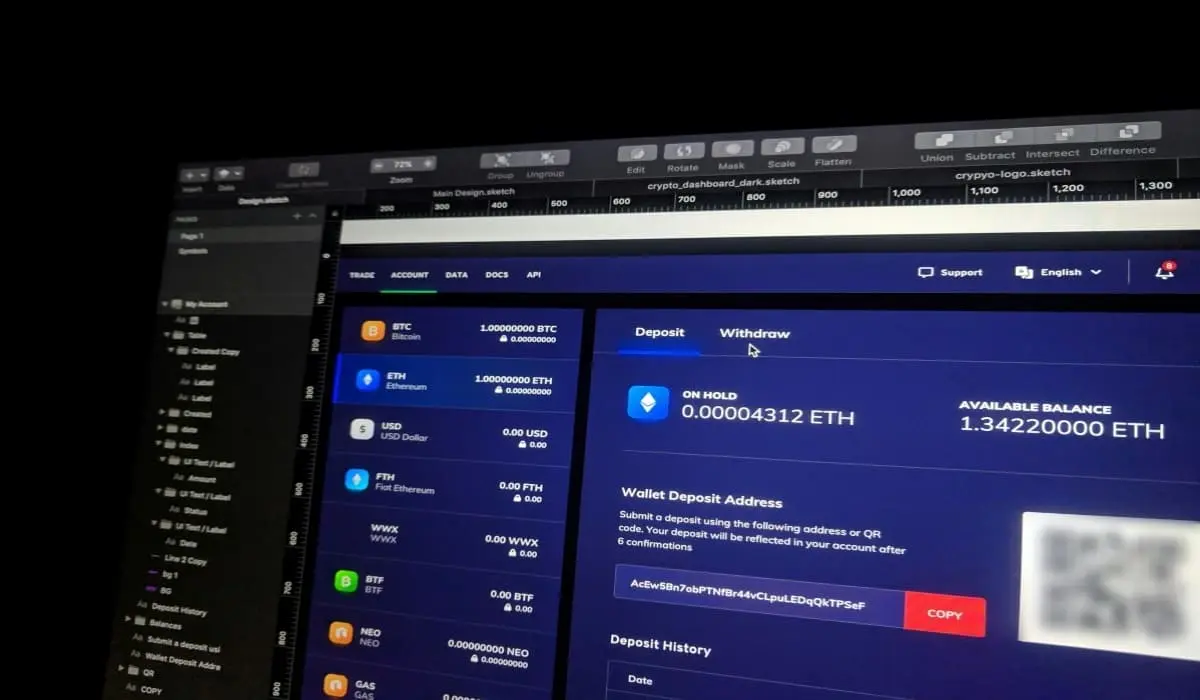

Currently, Fannie Mae and Freddie Mac have strict requirements regarding virtual currency. They permit its use for closing and reserves only when it has been exchanged into U.S. dollars and is stored in a regulated financial institution, with sufficient documentation to verify the origin of the funds from the borrower's cryptocurrency account.

Meanwhile, the use of bitcoin as a form of collateral is on the rise among major banks. Institutions like J.P. Morgan have started offering loans where bitcoin exchange-traded funds (ETFs) are used as collateral. Goldman Sachs has been accepting bitcoin as collateral since 2022. An example of this trend is MicroStrategy’s subsidiary, MacroStrategy, which secured a $205 million term loan from Silvergate in 2022, backed by $820 million in bitcoin.

However, using bitcoin as collateral carries inherent risks. Regulatory filings reveal that if the bitcoin's value falls, borrowers may be required to deposit additional bitcoin or repay a portion of the loan to maintain a loan-to-value (LTV) ratio of 50% or below.

These developments highlight the evolving relationship between cryptocurrency and traditional financial systems. As federal housing regulators continue to explore the inclusion of crypto assets in mortgage applications, this could pave the way for broader acceptance of digital currencies in financial assessments and loan processes.

Published on: June 26, 2025, 5:02 pm