Bitcoin Price Collapse Spreads Weakness Across Crypto Sector

Bitcoin price collapse sparks sector-wide weakness, boosting crypto market volatility and investor concern. Learn causes, impacts and cautious steps for traders.

Page views: 2

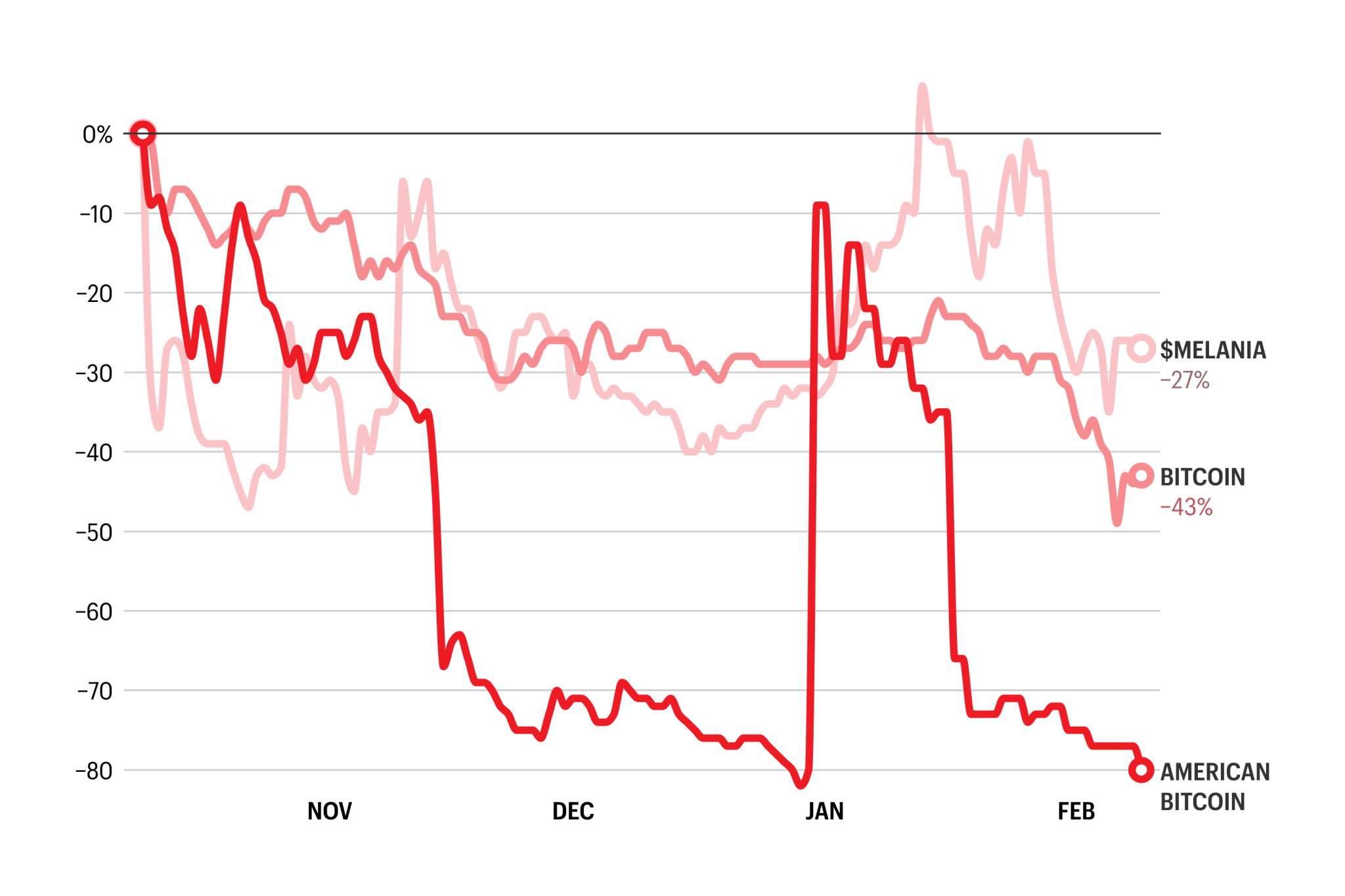

A recent collapse in the price of Bitcoin has spurred weakness across the cryptocurrency sector, increasing market volatility and investor concern. When Bitcoin — the largest and most visible digital asset — plunges, the ripple effects are often swift: altcoins, decentralized finance (DeFi) tokens, and crypto-focused stocks can all experience amplified selling pressure.

Possible drivers behind this Bitcoin price collapse include shifts in market sentiment, macroeconomic headlines, leveraged positions being liquidated, and sudden liquidity gaps. While no single cause explains every downturn, these factors commonly interact in times of stress. The collapse highlights how interconnected the cryptocurrency market has become and why Bitcoin movements remain a bellwether for broader crypto sector weakness.

The impact on investors and market participants is multifaceted. Retail and institutional crypto investors may see portfolio values decline as correlations rise during sell-offs. Smaller-cap altcoins often suffer larger percentage losses than Bitcoin, and some DeFi projects can face tighter liquidity or governance strain. Exchanges also feel pressure: trading volumes can spike while order books thin, creating wider spreads and more volatile price swings.

For traders and long-term holders, managing risk is essential during periods of heightened volatility. Consider these practical steps: review portfolio allocation to limit overexposure to any single asset; use position sizing and stop-loss orders to control downside; avoid trading on emotion during rapid moves; and keep informed through multiple reputable news and on-chain data sources. Diversification across assets and time horizons can help dampen the impact of sudden sector-wide weakness.

It’s also useful to remember that crypto markets are cyclical. Price collapses can lead to consolidation, shake out weak hands, and sometimes set the stage for later recoveries — though timing and outcomes are uncertain. Investors should conduct their own research and, if needed, consult a licensed financial advisor. This article is informational and not financial advice.

In summary, the recent Bitcoin price collapse has intensified crypto market volatility and spread weakness across the sector. By understanding potential causes, recognizing impacts, and applying disciplined risk-management practices, crypto investors and traders can better navigate these challenging market conditions.

Published on: February 10, 2026, 9:02 am