Bitcoin Drops to Six-Month Low — Is a Massive Crypto Correction Underway?

Bitcoin drops to a six-month low after a 25% pullback from an early-October rally. Learn why the crypto market is correcting and what BTC investors should watch.

Page views: 2

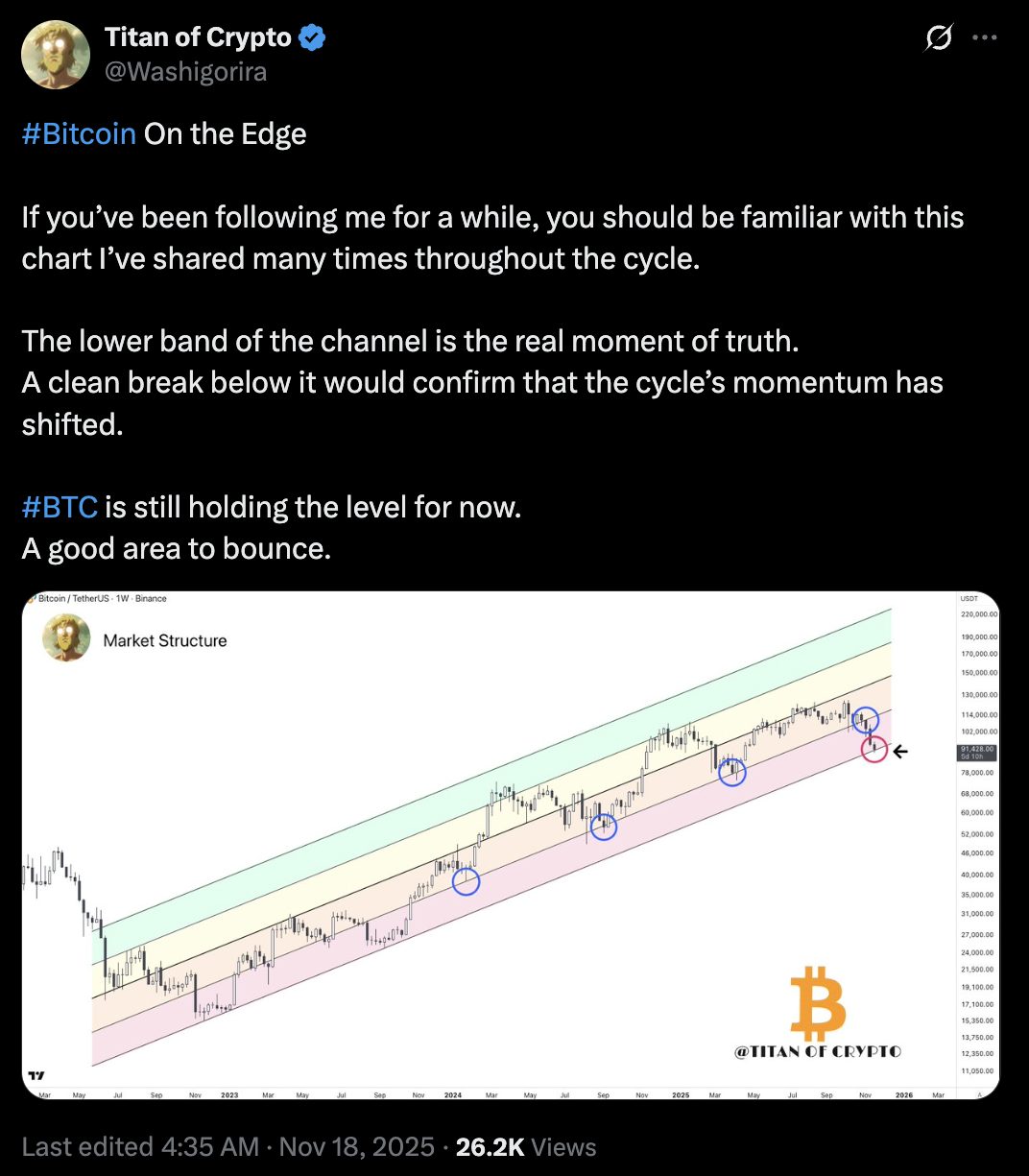

Bitcoin’s recent slide to a six-month low has reignited debate: is the crypto market due for a massive correction? After a blistering early-October rally that briefly pushed BTC toward roughly $126,000, Bitcoin has retraced nearly 25% in recent weeks. ValueWalk reported the downturn as a growing market sell-off intensified, and investors are now reassessing risk.

Several forces appear to be driving the decline. First, political optimism around a pro-crypto approach from President Donald Trump cooled, removing a bullish catalyst that had supported sentiment. Second, sharp rallies often invite profit-taking; after large gains, sellers reclaim gains and force weaker hands out of the market. Third, broader macro factors — including rising interest rates, a stronger dollar, or risk-off sentiment in equities — can amplify crypto sell-offs as investors reduce exposure to volatile assets.

Technical and on-chain indicators add context. BTC slipping to a “six-month low” signals that short-term momentum has shifted from buyers to sellers. Traders will watch key support levels and moving averages closely: a break below critical support could attract further selling, while a rebound at historically strong price zones could signal consolidation and eventual recovery. On-chain metrics such as exchange flows, realized volatility, and active addresses can help determine whether the sell-off reflects short-term panic or a deeper redistribution of holdings.

What should investors do? Risk management is essential. Diversify positions, set stop-losses, and avoid emotional trading based solely on headlines. Long-term Bitcoin investors may view dips as accumulation opportunities, but make decisions based on a clear strategy and time horizon. Short-term traders should monitor liquidity, order-book depth, and volatility spikes that can lead to rapid price moves.

Looking ahead, watch for renewed political clarity, macroeconomic data releases, and major liquidity events that can influence BTC price action. The crypto market’s cyclical nature means corrections are normal, but their depth and duration depend on both sentiment and fundamentals.

Whether this episode is a temporary pullback or the start of a deeper correction, staying informed and disciplined will be the best defense for investors navigating continued volatility in Bitcoin and the broader crypto market.

Published on: November 19, 2025, 9:03 am