Bill Bonner Critiques Michael Saylor’s Risky Bitcoin Strategy

Bill Bonner dissects Michael Saylor's risky Bitcoin strategy, highlighting key investment risks, market impact and what investors must know before following it.

Page views: 2

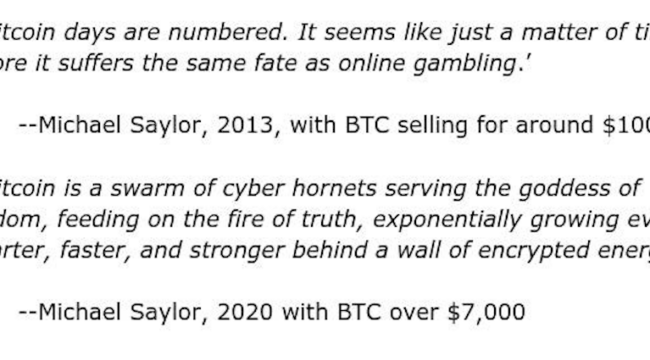

Bill Bonner, writing for the Daily Reckoning, has called attention to what he describes as a “bad strategy” in the way Michael Saylor has steered MicroStrategy’s corporate approach to Bitcoin. The critique raises timely questions about concentration risk, corporate governance and the broader implications for crypto investing.

Saylor’s approach—converting large portions of corporate treasury into Bitcoin and advocating for aggressive accumulation—made headlines for its conviction. But Bonner argues that such a concentrated bet exposes shareholders to outsized downside. When a public company ties its valuation to a single volatile asset, ordinary corporate protections like diversification and steady cash flow can be eroded.

Key risks Bonner highlights include extreme price volatility, potential liquidity problems, and the signal this sends to markets. Bitcoin’s price can swing dramatically on macro news, regulatory shifts or changes in investor sentiment. For a company whose stock performance is increasingly correlated with crypto markets, those swings translate into potential losses for employees, pension funds and retail investors who may not have signed up for crypto-level risk.

There’s also the governance angle: when executive leadership champions one speculative asset as the core corporate strategy, questions arise about fiduciary duty and risk management. Bonner suggests that boards and investors should demand clearer risk disclosures, stress testing and contingency plans rather than blanket endorsements of a single strategy.

So what should investors do? First, understand the distinction between cryptocurrency speculation and diversified investment strategy. Whether you’re an individual investor or part of an institutional fund, evaluate exposure limits, liquidity needs and exit plans. Second, scrutinize corporate decisions—read proxy statements, examine board oversight, and pay attention to how much leverage is being used to buy crypto.

Bonner’s critique in the Daily Reckoning is a reminder that conviction is not a substitute for risk management. Michael Saylor’s bullish stance on Bitcoin has reshaped debate around corporate treasuries and crypto adoption, but it also underscores a simple investing truth: concentration can amplify both gains and losses. Investors should weigh the potential upside of Bitcoin exposure against the real costs of putting too many eggs in one speculative basket.

Published on: December 12, 2025, 8:02 am